Greetings Rare Ones🎉,

Welcome back to series 9 Education + Adoption: Blockchain in Africa. Are you new here? Welcome to the family of Rare Ones. This is the Rare Birds Emerging Market Podcast Newsletter. Each week I send out this long-form newsletter to our community of Rare Ones as I have unique conversations with early-stage startup founders, ecosystem builders, and angel investors from across emerging markets. This long-form newsletter is a deep dive based on themes explored in the podcast conversation. Listen in by clicking above. 👆🏿

Get past podcast newsletters from the archives 👉🏾 here.

🎉 Featured Podcast from the Archive This Week🎉

To say Nedgine is a proud daughter of Haiti is an understatement. As an Obama Fellow Nedgine Paul Deroly hosted a closing session during her fellowship where she discussed exploring the power of place and why our roots matter.

👇🏿Have a Watch (i)👇🏿

Source: Obama Foundation

After having the podcast conversation with Nedgine, I immediately thought, “Everyone needs a Nedgine in their life.” The power of presence and purpose are two salient impressions Nedgine left on me. As Haiti continues to grapple with its challenges this year, I encourage all Rare Ones to be reminded that there are many like Nedgine who work tirelessly towards building a Haiti that is not reflected in mainstream media. Listen in to my conversation with Nedgine below. It is a great inspiration starter for the week ahead.

📌Episode 43 with Nedgine Paul Deroly in Haiti: Building a Movement of Civic Leaders, rooted in an appreciation of culture, customs & community

🎉 Coming to the Rare Birds Emerging Markets Podcast🎉

Episode 187 [Bonus Series] Introduction to Guyana: Startup Nation! A three-part series with entrepreneur, Guyana Focused Frontier Market Merchant Banker, and Asset Manager Steven Jasmin. Listen to Steven and me in conversation about all things Guyana. On Friday 3 September we will be releasing the first episode. Below is a snippet.

👇🏿Have a Listen (ii)👇🏿

Mr. Jasmin is Group Chairman and Managing Director of Smart City Clearing Company Ltd. a BVI based frontier market Merchant Bank. The bank’s focus is working with High Net Worth and Institutional clients across all aspects of the Alternative Investment Class as they look to invest and participate in Guyana’s growth. His practice focuses on four key markets: Commercial Real Estate, Oil & Gas Service Companies, Infrastructure Development, and Technology. To learn more about his origin story, follow the LinkedIn Article he posted: "Finding the Path to El Dorado in Guyana".

With over 15 years of experience as a Management Consultant and Investment Banker for Fortune 500 and Middle Market Companies, he has experience spanning all aspects of business but prefers to focus on Corporate Finance and Investment Banking. He is able to bring a deep and significant skillset as well as an extensive world-wide network with key relationships to bear for his clients and partners. Some of his clients have included: Delta Air Lines, Coca Cola, Johnson & Johnson, GlaxoSmithKline, Pfizer Pharmaceuticals, and Proctor & Gamble. Prior to being a Fortune 500 consultant,

Mr. Jasmin is also a former registered Investment Banker. He has worked as a Managing Director for Corporate Finance Associates where he oversaw deals across the entire alternative investment asset class. Prior to working with CFA, Steven was Vice President at the boutique investment bank Street Capital. Steven’s network and background as a former FINRA registered investment banker and management consultant allows him to bring a unique perspective to every opportunity.

With a degree from the Goizueta Business School at Emory University, and over 15 years of business experience in the fields of finance, marketing, information technology, and operations, Steven has an eye for detail across all spectrums. Recognizing that successful companies are built over time he is driven to employ his business acumen and broad skill set to help his partners and portfolio companies achieve their desired goals and long term financial success. Steven resides in Atlanta, Georgia but spends the majority of his time in Guyana as he works to help the country navigate through first oil and beyond.

🎉 Everything Blockchain [News and Podcasts] from Emerging Markets this Week🎉

📢 How Blockchain Encourages Middle Eastern Women

📢 Brazil President Meets with Brian Brooks and Circle to Discuss Possible CBDC

📢 Ukrainian Ministry Considering Digital Currency Pilot for Staff Salaries

📢 Union Bank of Philippines Partners with Hex Trust to Enter Digital Asset Ecosystem

📢 [Podcast] Why Bitcoin Matters in Nigeria and Iraq

Get more👇🏿

here

“My work was to support big and small companies in their digital transformation journey [enterprise architecture and IT consulting].… I met blockchain on this journey and I fell in love with it because it is the first technology where you have to do end-to-end discussions… I fell in love with this concept.” Tarek Kamoun

I always relish the stories of how persons found their way into blockchain. The moment of discovery is always filled with nuggets from which to draw inspiration. At age 18 Tarek left his country Tunisia to study at INSA Rennes. Upon completing his degree in computer engineering he joined Wavestone Consulting. He remained there for a decade before making his “exit.”

“Work takes on new meaning when you feel you are pointed in the right direction. Otherwise, it’s just a job and life is too short for that.” 1

To many of us, the “exit” is relatable. The terrifyingly beautiful moment when we realise something else is calling. It called and Tarek followed. The challenges of building a startup are immense. Building a startup between two continents, using local talent to serve a global market, even more so!

This week in blockchain education and adoption across the African continent Tarek shares his journey as a founder building a blockchain consultancy and shares insights on the blockchain ecosystem in Tunisia. We will explore the conversation with a series of essential BIG Questions, so together we can collectively understand: Leveraging Local Talent to Serve International Clients.

To begin, K2LIS, the consultancy of which Tarek is the founder and CEO is focused on adding business value through blockchain technology. Tarek and his team work across a wide sector of industries to provide an end-to-end support professional service. Tarek’s entire team is Tunisian-based, their clients, however, are in France and scattered elsewhere across the globe.

One of Tarek’s many talents is his ability to use leverage to his advantage. He leveraged his time in France to acquire an education, secure a job and eventually start his own business. Beyond that, he was able to identify three inefficiencies in the systems where he operated [France and Tunisia].

🌱 Essential BIG Question: How does perception vs reality create opportunities for emerging market founders?

Many emerging market regions are often overlooked. This is mainly due to a perception problem. The perception problem does not negate the fact that there are real challenges on the ground to overcome. There are countless struggles, however, being from these markets suggests one has a depth of understanding of how to circumvent said problems. What others see as a nightmare (perception) could be your nirvana (reality). In the case of Tarek, he believed blockchain technology had huge potential to solve the financial inclusion problem. He registered his company first in Tunisia and later in France. His first project was with a startup in Mali.

📌Must Read: The Emerging Market Grind: How ‘Doing More With Less’ Leads To More Resilient, Scalable Startups by Sebastian Vidal, CIO of Puerto Rico Science, Technology and Research Trust.

Excerpt: Ironically, the dwindling funding flows in emerging markets mean frontier startups take a more balanced approach to their growth, honing in on building resilience into their models, and taking a longer-term business outlook.

In fact, research reveals that entrepreneurs in emerging markets have a better survival rate than those in the United States. Surprised? Don’t be — here’s why startups that want to become profitable and enduring, fast, should consider starting up in emerging markets.”

📌Suggested Listening: Rare Birds Emerging Markets Podcast Series 8: Exploring the Puerto Rico Startup Ecosystem. Episode 178 Building Global Startup Accelerators that Create Impact with Sebastian Vidal

As the saying goes, we don’t see things as they are, but rather what we are. Everything is rooted in perception!

“It was one of the reasons I left consulting. I was frustrated with not being able to go to the end.” Tarek Kamoun

🌱 Essential BIG Question: What was the unmet need in the marketplace?

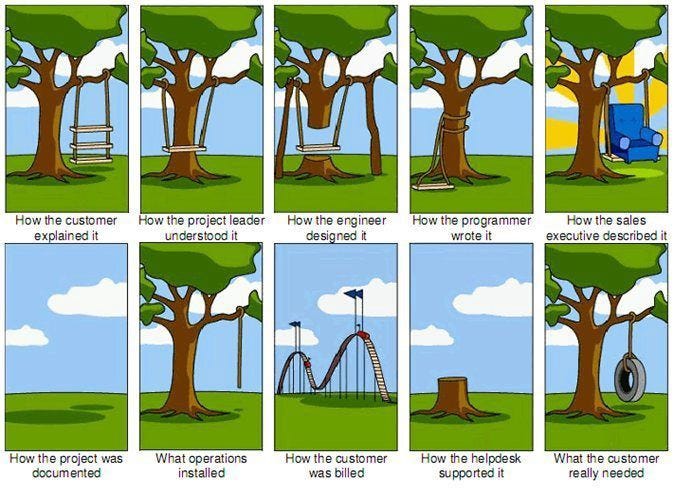

Working in a consultancy has its advantages and disadvantages. Consultancies make a profit by charging high fees to clients in exchange for the services of exceptionally talented professionals. Work is done on a contract basis for a specified period of time. As a result, the opportunity to work from inception to completion of a project is limited. Moreover, the animation below underscores the idiosyncratic nature of consultancies.

👇🏿Have a Glance (iii)👇🏿

Source: Shutterstock

Tarek mentioned in our conversation that this model is currently under evaluation by larger firms. For him, it was an opportunity to approach the entire process differently. Training is a key part of the K2LIS framework. Ensuring the client understands the technology and how it can add value is essential to the onboarding process. Tarek outlined three typical client profiles:

⚗️ Those Who Know

⚗️ Those Who Think They Know

⚗️ Those Who Know Nothing

The middle layer he says is the most challenging to work with as they tend to have a fixed mindset around what is feasible. In addition to educating his clients, Tarek discussed the concept of blockchain business design. By introducing business cases to his clients, he can identify and assist with building a viable blockchain business model.

Must Listen: Insureblocks Podcast. Episode 81: Blockchain Business Design

Excerpt: “In this fascinating episode we are joined by Andy Martin, Blockchain Business Design at IBM. For the last three years, Andy has been working on how to create a business case for blockchain networks. In this podcast, he shares with us his deep wealth of experience in how to design effective blockchain business design. This is a must listen to anyone interested in establishing blockchain networks.”

One resource mentioned, which I thought was helpful in the conversation was the Oxford Blockchain Strategy Framework. Tarek found it incredibly useful in his practise. It is a framework that consists of three layers and is comprised of six key questions used to assess blockchain suitability.

👇🏿Have a Glance (iv)👇🏿

Source: Yusuf Barman

The six questions work towards identifying one or more of the following:

A predictable and repeatable process

A recurring process

Multiple stakeholders participating in a value chain

A central trusted party responsible for reconciling disparate data

An element of value transfer

A need for immutability or a permanent unaltered record.

The idea is, to begin with, the problem and work through each point in a methodical approach to arrive at a conclusion that is beneficial. If none of the key areas are identified then suitability is not achieved.

“If they are open we can find a use case which is innovative, if they are open to creativity and it depends on the company strategy.” Tarek Kamoun

🌱 Essential BIG Question: How important is it to invest in human capital?

Tarek mentioned that Blockchain in Tunisia is still very nascent. He says a few startups are specialising in the sector to develop projects. Penetration is still too low. Overall there is a lack of knowledge, skills, and training. In terms of cryptocurrency, there is no regulatory framework in place at the moment, therefore it is considered illegal. That said, it is currently under discussion.

Employee Training

As with his clients, Tarek also values education internally. He learned the blockchain process, applied and developed it with his team. He developed both the team and company systems simultaneously. Investing in local talent benefits firms long term. That said, as we know, it is not without its peaks and troughs. As Tarek outlined talent is scarce, particularly in the tech field. The big elephant in the room? What happens when one trains local talent only for them to leave for better opportunities abroad? In the case of Tarek, this could potentially be one of his clients in France or elsewhere. This is all part and parcel of the risk involved with building! All that said, to date, this has not been his experience, as he tries his best to ensure his team is both happy and fulfilled. The underlying issue in question is value. Top tech talent will demand higher pay, which many local startups may not be able to provide. How can we build a robust ecosystem if we are unable to develop and retain top talent?

Thinking Point

Various companies are working towards solving the local talent pipeline problem across the African continent. Web3Bridge, led by Awosika Ayodeji and his team is one such organisation. Simply put they are providing Africa’s access to a new web, with a mission to identify Web3 Passions, train them in a collaborative and supportive remote environment and create an African web3 community. Listen to Awosika and me in conversation as he shares with me his vision.

In a 2019 Techpoint article Kennedy Kirui, Co-founder and CEO of Made by People, a Nairobi-based design thinking and software consulting company helping organizations build products for African markets declared:

“It is up to startups to invest more in building the next generation of senior developers and not just wait for others to do this. Of course, you still need senior talent who will set the right processes and culture but the onus is on startups to do the upskilling.”

Seems Tarek and Kennedy are the generation of homegrown African founders who share a similar mindset.

“At the moment we are prioritising quality over quantity.” Tarek Kamoun

Final Thoughts

Tarek personifies one truth, which is that we can all use the cards that we have been dealt to build something far greater than ourselves. His journey is a constant reminder that there is immense power in leverage. More importantly, when accessed it [leverage] becomes an unstoppable source of motivation.

Almost a decade ago, Tunisia was the birthplace of the so-called Arab Spring, an unforgettable series of uprisings that spread across what is commonly referred to as the Arab world. These past few weeks saw headlines in mainstream media of political instability in the country. Like Nedgine, Tarek [and all the other Rare Ones featured on this platform] continue to build away as daughters and sons of the soil, in spite of the uncertainty!

Tarek and I covered quite a bit in this conversation:

EPISODE HIGHLIGHTS

Get to Know Tarek

Selecting His Career Path Post University

Building His Startup in Tunisia and France

Why Blockchain? Changing Value in a Secure Way

The Beginnings of K2LIS: Tarek’s Blockchain Startup

Providing End-to-End Support Professional Services

Acquiring His First Client

Sourcing Talent to Start the Business

Understanding the K2LIS Clients

The General Consultancy Business Model

Training the Client to Understand Blockchain Technology

Different Types of Client

Assessing Client Needs

Blockchain Business Design

Meeting Client Expectations

Blockchain in Tunisia: Skills & Regulation

Insights into Building the K2LIS Tech Team

Challenges of Retaining Local Talent

Lessons Learned

Don’t Stay Alone-Don’t Hesitate to Discuss Your Projects

Get Customers Before You Have a Product

Don’t Get Caught Up in a Sinking Boat

As always, thanks for reading and for exchanges, questions, critiques and collaborations message me via joann@rarebirdshq.com.

Bye for now and continue to stay Rare.

JoXx

Don’t Forget to Follow Rare Birds 👇

🌱 FaceBook 🌱 LinkedIn 🌱Twitter 🌱Instagram 🌱 YouTube🌱

Tim Cook

Share this post