Greetings Rare Ones🎉,

Welcome back to series 9 Education + Adoption: Blockchain in Africa. Are you new here? Welcome to the family of Rare Ones. This is the Rare Birds Emerging Market Podcast Newsletter. Each week I send out this long-form newsletter to our community of Rare Ones as I have unique conversations with early stage startup founders, ecosystem builders, and angel investors from across emerging markets. This long-form newsletter is a deep dive based on themes explored in the podcast conversation. Listen in by clicking above. 👆🏿

Get past podcast newsletters from the archives 👉🏾 here.

🎉 Featured Podcasts from the Archive This Week🎉

The Caribbean

🤙🏿 10 August 2021: Luhu Gets Silicon Valley Funding. Want to learn more about Luhu? Listen in to my conversation with its founder below. 👇🏿

📌Episode 141: The Willingness to Learn and the Ability to Adapt with Zwede Hewitt Founder of Luhu: A Resource Sharing Application

Africa

🤙🏿 10 August 2021: Chekkit raises $500k to authenticate and track products globally. Want to learn more about Chekkit? Listen in to my conversation with its founder below. 👇🏿

📌Episode 143: Blockchain Beyond Payments with Dare Odumade from Nigeria, Founder & CEO of Chekkit Technologies, Inc.

In addition to this weekly podcast newsletter, I send out the Weekly News Round Up , an action-packed weekly curation of emerging market blockchain [news and podcasts] from across the web, featured in the Rare Birds Magazine.

A Snippet

📭 Blockchain News This Week

📌 Indian social media influencers are marketing cryptocurrencies like soap and shampoo

🎙 Blockchain Podcasts This Week

Get more from this week’s issue (#29) & sign up to receive your round up👉🏾 here.

Receive My Sunday Sevens (In Images)🌱 a list of seven items I explored during the week.

🎰 Quick Recap

👉🏾Analysis from the Rare Birds Emerging Markets Podcast

👉🏾News from the Rare Birds Magazine

👉🏾Exploration from My Sunday Sevens

“ A few crypto meet-ups and partnerships later my passion inclined toward the [blockchain] space.” Roselyne Wanjiru

Roselyne’s Twitter moniker is Ms. Blockchain. A simple Google search of her name will reveal that she is a prolific speaker across the African continent.

Africa Tech Summit-Kigali

NTV Kenya-Financial Literacy

Africa Bank 4.0 Summit

Crypto Currency Academy: Understanding Money

Are just a few of her rounds on the speaking circuit. Moreover, she is the Director of Growth and User Acquisitions at PesaBase, a Nairobi-based payment transfer company.

This week in blockchain education and adoption across the African continent Roselyne provides an overview of blockchain investing using business cases. We will explore with a series of essential BIG Questions, so together we can collectively understand: Investing in Blockchain.

“Invest in things you understand; learn the framework.”1

Roselyne confirmed for us that investing in anything blockchain is risky. One should only invest what they are willing to lose. More importantly, it is imperative to do your own research (DYOR). Nothing that you listened to or read here is investment advice of any kind. That said, let’s recap where we have been:

#181 The Fourth Industrial Revolution (4IR) & Blockchain with Aurra in Zimbabwe

#182 Decentralised Politics (DePo) with Abdelfatah from Morocco

#183 The Three Layers of Blockchain Education with Peter from Nigeria

#184 Education When Building a Blockchain Startup with Pascal from Cameroon

In four months it will be exactly 2 years since I have experienced my first global pandemic. Digital transformation enabled most of us in China to live comfortably, during our 3-month lockdown. I am not entirely sure we will ever have a post-pandemic existence but what I am certain about and something which Roselyne stressed is that we have become aware of how inefficient much of the global systems have been. We (systems included) are far weaker than we are willing to admit. Moving forward how can companies use blockchain technology to shield themselves from the unexpected?

“Post pandemic we will need to have processes’ that deliver value for us.” Roselyne Wanjiru

🌱 Essential BIG Question: Which companies are investing in blockchain?

There are many companies around the globe leveraging blockchain technology. Reduced operational costs, simplification of business processes’, and transparency are just a few ways the technology is being utilised.

👇Have a Glance (i) 👇

Source: IQ Direct

🌱 Essential BIG Question: Why are companies investing in blockchain technology?

IBM was one of the first companies to invest in blockchain technology. The company has its own IBM Blockchain Platform, which provides advanced tooling that allows developers to quickly build, operate, govern and grow blockchain networks using Hyperledger Fabric. In short, it is blockchain-as-a-service (BaaS).

Must View: IBM Blockchain

Excerpt:

Decision-makers in business are increasingly looking to blockchain technologies to improve efficiency, reduce costs and reduce risks. Blockchain creates synergies among multiple, permissioned organizations, which enables you to create entirely new, higher-value business models. Building on the software and interface of the IBM Blockchain Platform gives you the flexibility, speed, and power you need to deliver on the promise of blockchain.

Suggested Listen: Blockchain Won’t Save the World Podcast by IBM Blockchain Partner Anthony Day. He believes, like most that blockchain has a marketing problem and this podcast aims to share stories.

Excerpt:

Cutting through the hype, telling inspiring stories from people and organisations who are creating real change in the world with Blockchain and Exponential technologies.

🌱 Essential BIG Question: Outside of cryptocurrencies what are some other alternatives for blockchain investing?

In our conversation, Roselyne mentioned the multiple ways in which investors may venture into blockchain beyond cryptocurrencies.

Must Read: Coinmarketcap Learn Centre

Suggested Reading: Not Boring by Packy McCormick: The DAO of DAOs

Excerpt: “Unlike a traditional fund, in which institutions and high net worth individuals (Limited Partners or LPs) invest money into a fund that other people (General Partners or GPs) invest into companies, investors in The DAO would be able to vote on proposals based on pre-set rules, established in smart contracts. Each person’s vote was weighted by the number of tokens they held, which was based on how much they had invested. If a proposed project received enough votes, the smart contract automatically triggered the investment of The DAO’s funds into the project’s ETH wallet.”

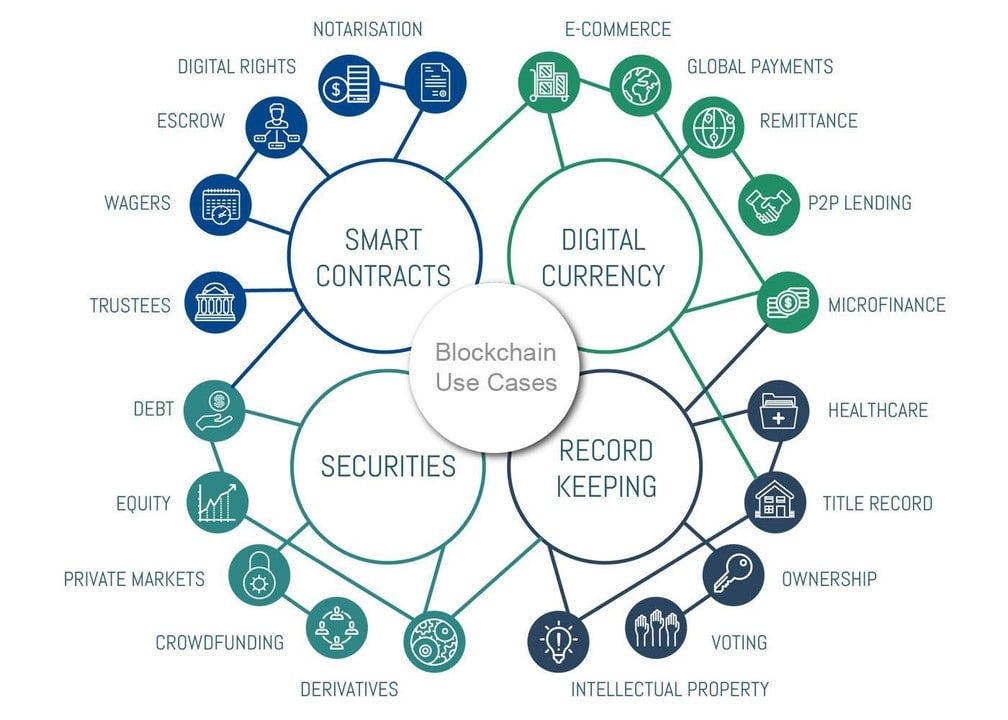

🌱 Essential BIG Question: What are some business use cases for blockchain technology? In newsletter #181 The 4th Industrial Revolution & Blockchain Education + Adoption-Blockchain in Africa I provided the below visual.

👇Have a Glance (ii) 👇

Source: Interesting Engineering

These can be further broken down to include:

Energy and Sustainability

Insurance

Health Care & Life Sciences

Supply Chain Management

Insurance

Law

Real Estate

Shipping

The video below demonstrates the tokenisation of real estate using blockchain. It is one way in which investors are using blockchain in very traditional industries such as real estate.

👇Have a Watch (iii) 👇

Source: Armanino

🌱 Essential BIG Question: What are the consequences when code is law?

“Who do we blame when the code fails? Is therefore the code within the smart contract the law? Or do we need the existing law within the country? If there is a dispute within the code, who do we blame? The smart contract developer? The protocol? Or do we just go to court and sort our issues?” Roselyne Wanjiru

Thinking Point

Roselyne mentioned that governance protocols are currently being debated due to the lack of clarity around legal frameworks. The lines are being blurred and Roselyne believes this is where ethics (human-driven) has a role to play in the discourse. How do we apply ethical guidelines to blockchain technology? Is this a redundant question? What rights do investors have? Like regulation, ethics is a sensitive topic but as the industry matures and evolves, I believe we will see more robust debate on said topic.

Final Thoughts

At the end of our conversation Roselyne mentioned: people, technology and innovation as the three pillars for investor success. Her varied experience and skills set is a constant reminder that the biggest risk in investment is not the asset but the investor. The onus is on all of us to develop our own strategies for success which align with our personal short-term and long-term goals.

Roselyne and I covered quite a bit in this conversation.

EPISODE HIGHLIGHTS

Get to Know Roselyne

Roselyne’s Business Experience

Learn About Pesabase and What Roselyne Does There

Beyond Crypto: Other Tools for Investing

A Focus on Decentralised Autonomous Organisations (DAO)

Traditional Finance (CeFi) vs Decentralised Finance (DeFi)

Understand Governance Protocols

The Role of Trust

Risk and Blockchain Technology

The Role of Education in Advising and Informing Investors: Three Pillars

Lessons Learned

As always, thanks for reading and for exchanges, questions, critiques and collaborations message me via joann@rarebirdshq.com.

Bye for now and continue to stay Rare.

JoXx

Don’t Forget to Follow Rare Birds 👇

🌱 FaceBook 🌱 LinkedIn 🌱Twitter 🌱Instagram 🌱 YouTube🌱

Michael Lee-Chin

Share this post