Greetings Rare Ones🎉,

Welcome back to series 9 Education + Adoption: Blockchain in Africa. Are you new here? Welcome to the family of Rare Ones. This is the Rare Birds Emerging Market Podcast Newsletter. Each week I send out this long-form newsletter to our community of Rare Ones as I have unique conversations with early stage startup founders, ecosystem builders, and angel investors from across emerging markets. This long-form newsletter is a deep dive based on themes explored in the podcast conversation.

The Rare Birds Emerging Market Podcast Newsletter is written for Emerging Market early-stage startup founders, ecosystem builders, angel investors, and the curious. Rare Ones come here to gain fresh perspective and insights into what is happening on the ground in emerging markets from the people who are creating shifts and driving the action. It is where they can connect through stories that are distinctive, honest, and relatable. Join your fellow tribe of Rare Ones as we course correct and create new narratives together!

Get past podcast newsletters from the archives 👉🏾 here.

Additionally, I send out the Weekly News, an action-packed weekly curation of emerging market blockchain news and blockchain podcasts from across the web featured in the Rare Birds Magazine.

🔶 A Snippet 🔶

⛓ Blockchain News This Week:⛓

📑 Akon’s Akoin pilot heralded a success, eyes countrywide rollout in Kenya

📑 Indian Government Working on Blockchain Framework to Ease Startup Compliance

⛓ Blockchain Podcasts This Week:⛓

📻Positive Social Impact with Microfinance in Brazil featuring Taynah Reis

📻 Crypto from an African Perspective with STLFX featuring Alex Matu

Get more from this week’s issue (#28)👉🏾 here.

💁🏽 New Feature in Female Founder Stories💁🏽

📖 Let’s Start Now: Sharing Journeys to Inspire and Inform. Meet Patience & Laure Podcasters from Rwanda📖

Lastly, receive My Sunday Sevens (In Images)🌱 a list of seven items I explored during the week.

🔶 Quick Recap 🔶

☛ Analysis from the Rare Birds Emerging Markets Podcast

☛ News from the Rare Birds Magazine

☛ Updates from My Sunday Sevens

“Kanza stands for change in the Hausa language. It is basically a peer-to-peer neo bank. What makes Kanza unique is that we try not to reinvent the wheel.” Pascal Ntsama IV

Pascal’s venture into the startup world was not one of building in the basement or dropping out of university. He did what the majority do: he got a corporate job whereby he worked and learned from 9-5 and then took on his passion/side projects from 5-9. I think it was Robert Kiyosaki who said, jobs are for learning. Insert [Pascal] the learner. He was employed by some of the biggest names in the industry (IBM, Sprint, and AT&T) before branching out on his own. He developed skills which he believed would transfer to the startup world, once he decided to leap.

This week in blockchain education and adoption across the African continent we head to Cameroon (Africa in Miniature) to hear from Pascal Ntsama. We will explore with a series of essential BIG Questions, so together we can collectively understand: Education When Building a Blockchain Startup.

“You can’t learn anything new, until you are open enough to forget everything you think you know.” James Victore

Pascal mentioned the importance of stepping into emerging markets with an open mind. In his own words, “Walk in like you come from Mars.”

🌱 Essential BIG Question: How did Kanza go about solving the problem?

Kanza is facilitating existing infrastructure by updating it with the use of technology. Pascal started by observing trends. He noticed that there was an individual financial system that existed among people in the region. People were using local currency exchange agents to facilitate trade. The main problem was the risks associated with the devaluation of local currencies. This subsequently led to a spike in the use of cryptocurrencies.

“It was an untold story that perhaps explained why people were not so quick to change things or jump on an online platform.” Pascal Ntsama IV

To put the devaluation of currencies into context last week it was reported that Nigerians Moved Over $40 Million Worth of Bitcoins in July 2021.

👇Have a Glance (i) 👇

Source: Useful Tips.Org

The devaluation of currencies was a theme we touched upon in #181 The 4th Industrial Revolution & Blockchain Education + Adoption-Blockchain in Africa. Devaluation in currency tend to contribute to inflation.

Excerpt: “Aurra mentioned in our conversation some of the economic disenfranchisement that Zimbabweans experience. Zimbabwe’s modern history is one to be studied and dissected at length to make sense of its position today as a country wrought with economic woes. In 2008, it had the world’s highest recorded inflation rate in history, at 89.7 sextillion percent.”

We also learned about the currency problem in #180 The Blockchain Potential in Somalia: Education + Adoption-Blockchain in Africa.

Excerpt: The government doesn't have its own currency (we've been using the dollar for 30+ years).

🌱 Essential BIG Question: Why a neobank?

As Pascal told me neobanks are basically financial providers that do not operate like a typical bank. They are usually small and decentralised and work with a different type of model. They are more community-oriented and address issues faced by the average daily individual. Unlike many, Pascal is of the view that both neobanks and traditional banks have a role to play in the ecosystem. One salient point made in the conversation was the narrative of the unbanked. Pascal, like other African founders, speak openly about their issue with the term unbanked. He asserts that it does not really represent the wider narrative, but has instead become another catchphrase.

“Stop using the word unbanked and shift to underserved.” Pascal Ntsama IV

Below is a snapshot of the world’s top neo-banks.

👇Have a Glance (ii) 👇

Source: Fintech Industry Research, January 2020

Suggested Reading: FT Partners: The Rise of Challenger Banks

Excerpt: “Emerging markets such as Africa, South East Asia and Latin America present a large opportunity for challenger banks, due to large unbanked populations, high mobile penetration and a growing middle class.”

🌱 Essential BIG Question: What were the ten key takeaways from Pascal’s product building experience?

1️⃣Don’t make assumptions, open your ears,

2️⃣Word of mouth is the big marketing engine,

3️⃣Think locally, find people that share the same passion as you and onboard them to your project,

4️⃣Work with local talent,

5️⃣Take advantage of technology (Whatsapp Data is cheap in SubSaharan Africa),

6️⃣ Natural observation is very important,

7️⃣ Language is key,

8️⃣ Come down to the user level,

9️⃣ Ship fast and learn,

🔟 It is all about relationships.

It appears, the underserved are not always in need of a new solution but perhaps a more upgraded and convenient solution. Pascal went into detail about how he and his team used and continue to use WhatsApp to build the company. In emerging markets where using WhatsApp is common and cheap, this is highly effective. Meeting people where they are and employing technology they already use is always a win-win! Below are a few case studies from South and South-East Asia.

Must Read: Startup Founders Are Building Companies on WhatsApp

Excerpt: “Sampingan, an Antler portfolio company founded here in Singapore, provides an on-demand workforce to businesses in Indonesia. The first version of the product was on WhatsApp. The team sourced and managed more than 2,000 blue-collar workers in Indonesia who completed 25,000 jobs in the company’s first three months.”

Must Read: Building Startups on WhatsApp — the Evolution of the “No-Code” Movement

Excerpt: “In Asia, startups are regularly rolling out a minimum viable product and then transacting on messaging apps. Startups have found a way around hard-knock coding, and now run many services on top of WhatsApp, validating with customers quickly and cheaply. These companies are not only mobile-first, but they are also WhatsApp-first.”

Must Read: Meet the Indian startups and SMBs using WhatsApp to script a success story

Excerpt: “Hyderabad-based Digi-Prex entered the online pharmacy market in 2019. Operating on a subscription-based model, the platform is largely driven by orders on WhatsApp where patients with chronic diseases share their prescription. The orders can then be made on a recurring cycle at 15 percent cheaper rate than those offered at brick-and-mortar pharmacy shops, according to the startup.”

”Learn from them to solve their problem. They learn from you to understand your solution. It can never be one way, always a bi-directional exchange.” Pascal Ntsama IV

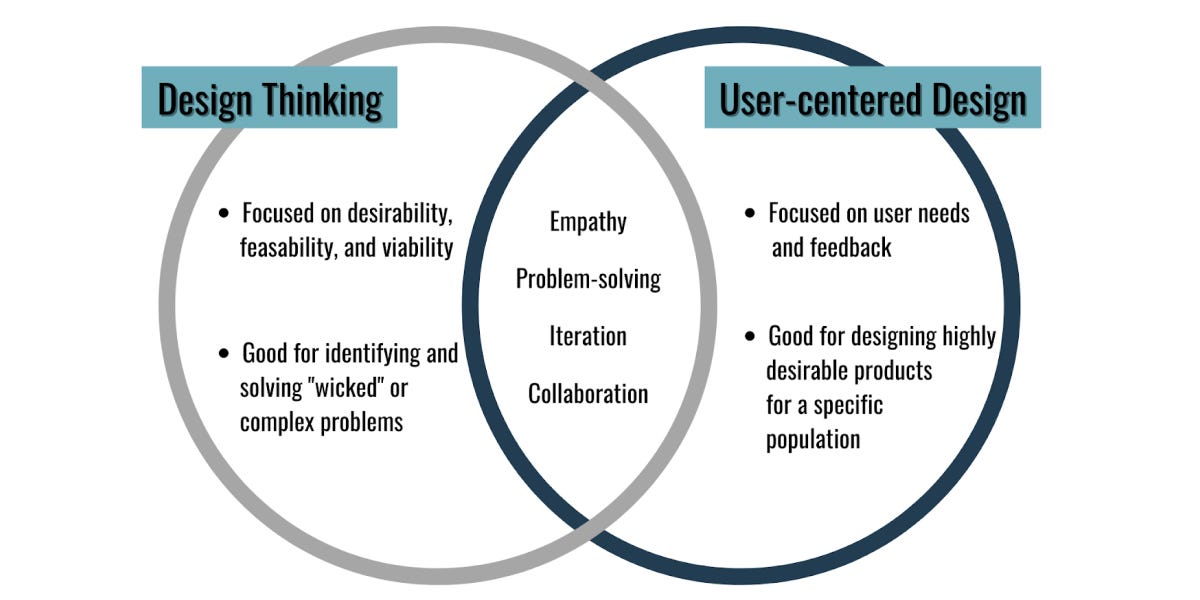

Below is a visual of the intersections between design thinking and user centric design. The middle ground is where Pascal believes startups can thrive when building in the blockchain space.

👇Have a Glance (iii) 👇

Source: Career Foundry

“The average person does not know what the best solution is to their problem. You also as the founder would not know what the best solution is either.” Pascal Ntsama IV

On Marketing vs Educating

Pascal mentioned some very important points around marketing. He outlined the different demographics-language, culture, religion, etc-which exist in one country on the continent making it difficult to market in the traditional sense. He mentioned the importance of studying the differences and leveraging them in the solution. He believes this is why education is far more important than marketing. Pascal explained that if founders can understand their customers enough to solve their problem, they will in turn educate someone else on using the same solution. As far as marketing goes word-of-mouth he believes is the best approach and will result in organic growth.

”People are bigger than technology.” Pascal Ntsama IV

Final Thoughts

At the time of writing this newsletter, Pascal was in Nigeria launching the product there. As he said in the conversation, it was a part of his bigger plan (Cameroon then Nigeria). His unfair advantage is that he borders two cultures and languages which help him to tap into several markets. Beyond his education, wits and obvious talent, Pascal aims for impact. It takes a bit of hubris to leave a secure financial position at a top global company to attempt what you believe is your calling. It takes humility to forget everything you’ve learned, unlearn and relearn in a new environment. That said, one senses Pascal has been preparing for this moment for a very long time. Like all his other ventures, his dedication is unwavering and perhaps we can all become better founders and humans with a little more bi-directional exchange.

Pascal and I covered quite a bit in this conversation:

EPISODE HIGHLIGHTS

Get to Know Pascal

Bridging the Corporate and Entrepreneurial Paths

Building Three Startups

Menergi Inc-Comcast & NBC Universal Partnership

Coincentrix Capital

Kanza-Saukibit

The Story Behind Kanzaa-Saukibit ( A peer-to-peer neobank)

The Role of Local Currency Exchange Agents

What are NeoBanks?

From UnBanked to Underserved

The Role of NeoBanks in Emerging Markets

The Diversity of NeoBanks

Attributes of a NeoBanks

Banking Becoming Flat

Startups Forget What You Know

Two Way (bi-directional) Exchange in Building a Startup

The Importance of Thinking Locally

Leveraging Social Media Platforms

Using WhatsApp as a Great Channel

Word of Mouth Marketing As an Engine for Growth

Solutions Should Remove Friction

Marketing vs Education

Building with Your Customer Using WhatsApp

Continuous Learning with Multiple Iterations

Scaling the Strategy

The Vision for Kanza-Saukibit

A View As to Why French-Speaking Africa Lags Behind in Startups and Investments

🔶 Visit Rare Birds TV for video podcasts with early-stage founders from emerging markets. Our most recent episode features Trinidadian entrepreneurs Carla Williams-Johnson and Jamila Bannister. View Rare Birds TV here. 🔶

As always, thanks for reading and for exchanges, questions, critiques and collaborations message me via joann@rarebirdshq.com.

Bye for now and continue to stay Rare.

JoXx

Follow Rare Birds 👇

🔶 FaceBook 🔶 LinkedIn 🔶 Twitter 🔶 Instagram 🔶 YouTube🔶

Share this post