Greetings Rare Ones🎉,

Welcome back to series 9 Education + Adoption: Blockchain in Africa. Are you new here? Welcome to the family of Rare Ones. This is the Rare Birds Emerging Market Podcast Newsletter. Each week I send out this long-form newsletter to our community of Rare Ones as I have unique conversations with early stage startup founders, ecosystem builders, and angel investors from across emerging markets. This long-form newsletter is a deep dive based on themes explored in the podcast conversation.

The Rare Birds Emerging Market Podcast Newsletter is written for Emerging Market early-stage startup founders, ecosystem builders, angel investors, and the curious. Rare Ones come here to gain fresh perspective and insights into what is happening on the ground in emerging markets from the people who are creating shifts and driving the action. It is where they can connect through stories that are distinctive, honest, and relatable. Join your fellow tribe of Rare Ones as we course correct and create new narratives together!

Get past podcast newsletters from the archives 👉🏾 here.

Additionally, I send out the Weekly News, an action-packed weekly curation of emerging market blockchain news and blockchain podcasts from across the web featured in the Rare Birds Magazine.

🔶 A Snippet 🔶

⛓ Blockchain News This Week:⛓

📑 Ripple Partners with SBI Remit, Coins.ph to use XRP for Japan-Philippines Remittances

📑 Colombian Bank Banco de Bogotá to Support Customers to Transfer funds to Crypto Exchange

⛓ Blockchain Podcasts This Week:⛓

📻Artists Can Collaborate to Create NFTs’ – A Chat with Founder/CEO, QLIP, a Leading African NFT Marketplace

📻 BlockDrops with Maurício Magaldi: Notarchain, DeFi with Bitcoin, Mastercard on stablecoins

Get more from this week’s issue (#27)👉🏾 here.

Lastly, receive My Sunday Sevens (In Images)🌱 a list of seven items I explored during the week.

🔶 Quick Recap 🔶

☛ Analysis from the Rare Birds Emerging Markets Podcast

☛ News from the Rare Birds Magazine

☛ Updates from My Sunday Sevens

Share Rare Birds

“Imagine a class of 100 students working on the same assignment on Google docs, whenever someone types a sentence the other 99 students see the sentence and if they click “I accept this" button that sentence is saved forever and cannot be reversed.” Peter Oluwashina, “Blockchain and Cryptocurrency: The New Oil

Five years ago, Peter discovered [The New Oil ] Bitcoin and like most, it changed the trajectory of his life forever. Peter is an entrepreneur, writer, cryptocurrency trader, and blockchain enthusiast. His main focus is education on all things blockchain and cryptocurrency in Africa.

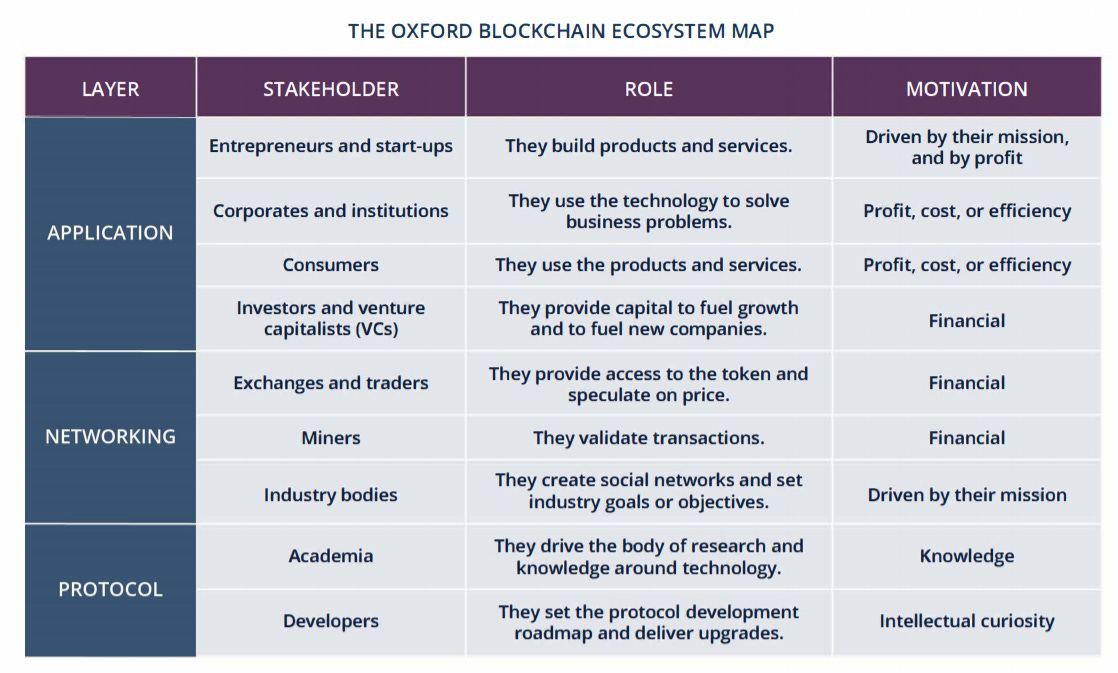

This week, we continue down the rabbit hole of blockchain education and adoption across the African continent. We will do so, with a series of essential BIG Questions, so together we can collectively understand: The Three Layers of Blockchain Education.

“No one can whistle a symphony. It takes a whole orchestra to play it.”

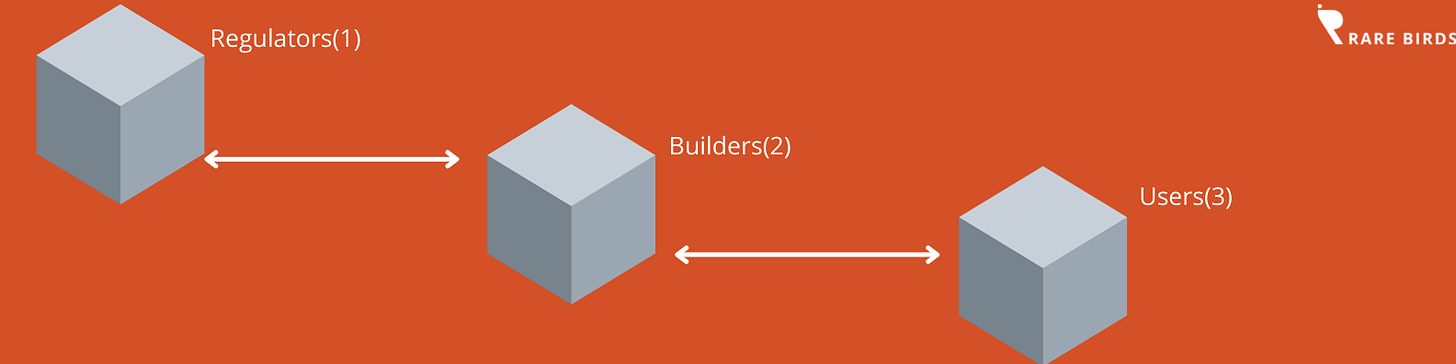

For Peter, the three layers of blockchain education must align. They ideally, should work in tandem for the overall mission to be achieved. If one is misaligned the entire system collapses. He asserts the three layers as:

👇Have a Glance (i) 👇

1. Regulators

In the past few months, governments the world over have been grappling with [The New Oil] and everything therein. We have witnessed a mixed bag of responses. From the flotsam fearsome to the coquettishly curious and the ardent adopters! It has been entertaining at times, and for ordinary citizens, a transparent IQ test. That said, what’s your country’s intelligence quotient? Below is a country-by-country breakdown from Argentina to Venezuela.

Must Read: Global Legal Insights: Blockchain and Cryptocurrency Report 2019.

Excerpt: “The concept of regulating a disruptive technology, is in itself unrealistic and unattainable as a result of the principle of “technological neutrality”. Technology changes exponentially, but social, economic, and legal systems change incrementally. Therefore, technology will always render regulation outdated, almost immediately. On the other hand, it is the very tendency of technology to evolve that is crucial in justifying the legal and regulatory change. The objective of regulation should never be to slow down or delimit technology, as this inevitably leads to stifling innovation. The focus should always be on creating standards as well as ethical and good governance principles as these are essentially the tools required for a new industry to mature, grow and flourish.”

In my conversation with Peter he said something which I believe rings true, “Adoption cannot happen without the government and the regulators.” He further added that governments need to be communicated with in a language they understand. It made me reflect on something one of my mentors told me many years ago, “Learn to speak the currency of your audience.” Many crypto thought leaders often stress that “banning” is more of a stalling mechanism which translates into simply put: we are trying to figure this out. What we have all collectively observed is that whilst some countries have been proactively ahead of the curve-researching, applying and developing-others have been sleeping at the wheel and are now-responding!

🌱 Essential BIG Question: How are some governments managing digital transformation?

In #180 The Blockchain Potential in Somalia: Education + Adoption-Blockchain in Africa. Abbas Gassem, told us,

“Government just needs to take the lead…Governments need to think and act like startups not like a state ran project.” Abbas Gassem

Meet Siim Sikkut, CIO of Estonia, the second to hold this position in his country.

Must Read: E-Estonia Interview with Siim Sikkut

Excerpt: What is it that a country’s CIO does daily?

Meets a lot of people and has a lot of conversations. But on a more serious note, my job is to lead and coordinate our digital state’s development. It’s being done through regulation, through investments and funding, by offering platforms along with Estonian Information System Authority – most notably our X-road. We also are going these days more hands-on and are driving new initiatives, like the current national AI strategy that seeks to boost the take-up of AI in both the private and public sectors. I’d also like to emphasize that it is not a one-man-show; in the Ministry of Economic Affairs and Communications, we have a Government CIO office. We are a team of about thirty people keeping the country’s digital innovation engine humming and cyber-safe.

Estonia is also a member of the Digital Nations Group, a ten-member country club that consists of Israel, Mexico, Uruguay, and South Korea to name a few. In the above interview, Sikkut mentioned that it maintains close relations with countries such as Singapore to learn from its track record as a leader in digital transformation.

Thinking Point

There are often discussions on emerging/frontier markets being better positioned to emulate models from China and/or South East Asia. I tend to agree with and understand the underpinnings of this sentiment. However, I think it is important to apply rigour to my thinking, in an attempt to recognise my own blind spots. The case for some divergent thinking: Ultimately the world is our oyster, we can learn from Estonia just as much as we can learn from Ethiopia, El Salvador, Ecuador, Egypt, Equatorial Guinea, Eritrea, etc. The learnings are complex and nuanced, perhaps not as relatable, but true learning stems from observing the world. Irrespective of where we lie on the globe, technology, once adopted must still be localised. We may not be able to apply in the same way as say, Estonia but let’s look at the bigger picture. Beyond emulation is another (e) known as experimentation, because ultimately all countries must look inward to develop a vision that best suits their own cultural, political, social, and economic makeup. There is by no means a “perfect model.” As a consequence, the emerging/frontier must grow and develop its own sense of self. Some may call it the ultimate (e) known as expression, which can only stem from self-determination. What is your thinking point on this?

Share Rare Birds

Reverting to the essential big question of managing digital transformation. The Gartner Hype Cycle may provide a view into how government CIOs consider implementing their digital strategies.

👇Have a Glance (ii) 👇

Source: Gartner

“Regulatory frameworks should be created as to not stifle the growth of blockchain projects and businesses.” Peter Oluwashina

As Peter shared the above with me I reflected on this most recent development: Nigerian Fintech company, Patricia recently announced the relocation of its operations to Estonia. The article which was published on Technextng: Patricia Relocates to Estonia cited one of the reasons for the relocation as a response to the ban on crypto trading by the Nigerian Government. Albeit, not his core area of expertise, Peter asserts that educating regulators forms a key layer in blockchain education. From Nigeria to Estonia, the world continues to be our oyster.

Follow Rare BirdsHQ on Twitter

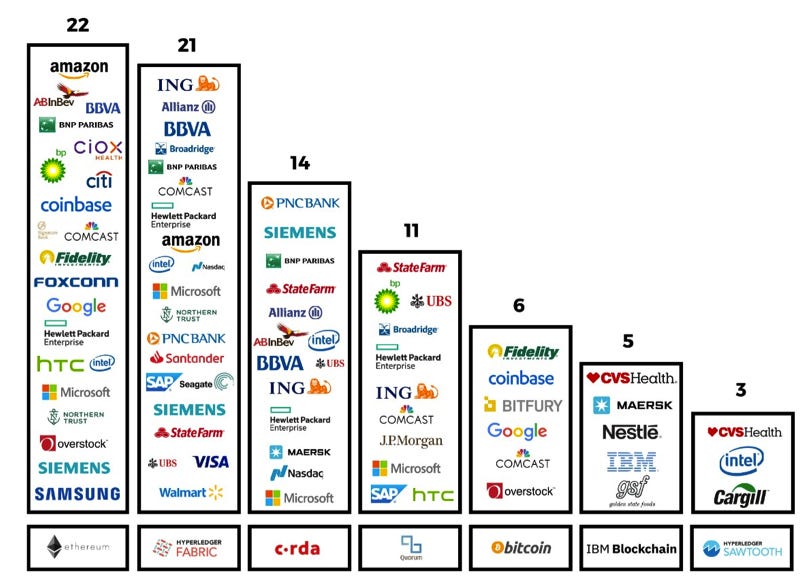

2. Builders

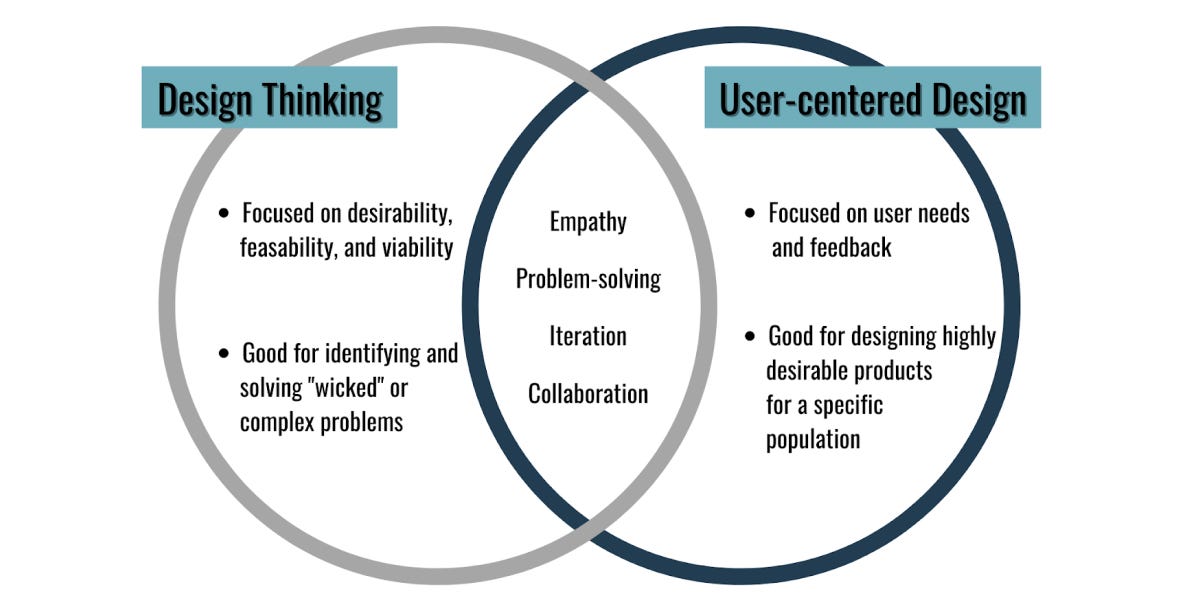

🌱 Essential BIG Question: Is putting the user first the answer to everything?

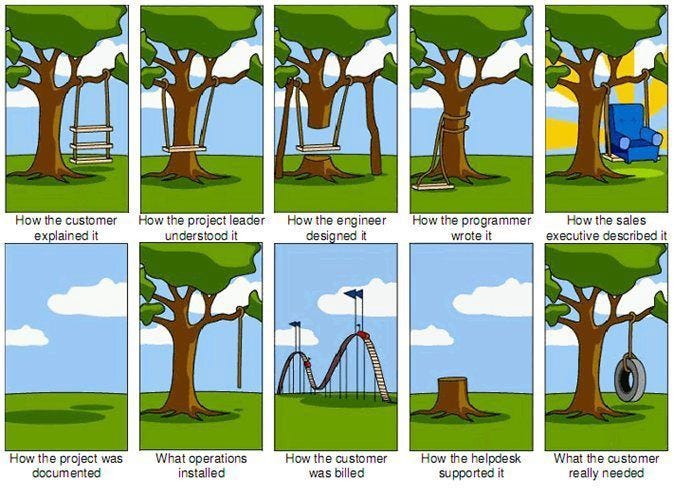

Startups generally have a high failure rate. However, in one of his blog articles, Why Blockchain Projects Fail, Peter outlines several reasons that are specific to blockchain builders. Peter sites a shortage of talent and expertise which he says can be solved if we attracted more diverse talent to the industry. He believes there is a very long value chain which can be optimised for efficiency. He states building is great but ultimately projects that do not solve problems, are failures.

“If no one is actually using your project it is a failure.” Peter Oluwashina

In his book,【The New Oil】 he details a lengthy thread of professionals as well as jobs sites for those seeking to enter the profession. Moreover, he states that the developer pool is limited, seeing as there are less than 200,000 blockchain developers in the world. At present, trying to source a senior blockchain developer or solutions architect is a considerable challenge. Those who are experienced at that level, are quickly poached by giant corporations. Below are a few of the professions listed in Peter’s book.

👇Have a Glance (iii) 👇

A. Startups as Builders: Lessons Learned

Last month Quartz Contributing Writer, Chikezie Omeje wrote a galvanzing article titled,

Must Read: “The inside story of how an ambitious African cryptocurrency startup failed.”

Excerpt: “The leaders held a retreat and agreed to pivot their startup. They figured out they couldn’t compete in the crypto exchange space, because competitors like Binance were already popular with African crypto investors. Instead, they decided to build a blockchain-enabled fintech that would facilitate faster payments with little service fees across Africa. They called it “money on steroids.” Their app users would be able to send money or receive money in the form of a token. This way, Africans could make payments across the continent without converting to outside currencies like the US dollar. “

Some of the challenges the startup encountered were:

Building Without Technical Know-How (Blockchain or Fintech)

Excessive Spending on Technical Partners Outside the Continent

Unnecessary Hiring

Not Conducting Market Research

Lack of Mentorship

The above are not unique to crypto startups but the founders were African-Angolan, Nigerian, and Ghanaian-and aiming to build for what they defined as an “African” market. They were also some considerable debates on Twitter as to whether the goal should be to build an African blockchain or build on existing blockchains. The entire conversation is ongoing and one I highly suggest observing.

A recurring theme amongst marketers is that startups tend to see marketing as an add-on. Peter firmly believes that marketing should be an integral part of product development. After working with various startups one of the biggest blunders he mentioned was a lack of focus on marketing.

“People do not care about the tech, what they want to know is this solving my problem. They want a solution to their problem.” Peter Oluwashina

He believes startups need educating on storytelling. He believes a marketer should be included at the outset; as early as the idea phase of the project. With most startups, he says the obsession tends to be with the product and not the users. In his view, the obsession should be solely on the users and consumers of the product.

Another ambitious African-based startup shared its lessons as builders in the blockchain space. In TechCrunch last month, they wrote about their experience building for African governments. This particular startup uses blockchain to help governments solve shipping problems. They have since expanded into offering land registration services via the blockchain.

Must Read: What We Learned From Selling a Blockchain Service to African Governments

Excerpt: It’s typical when entering Africa to want to focus on the big and popular markets like Nigeria, South Africa and Kenya. But what we’ve learned so far is that there’s a high probability that these countries might not be your first entry point. A business-to-government model is a difficult one. There’s a lot of politicking that goes into working with the government. What we’ve seen work is to approach other countries and gain a foothold, then use that as validation that the concept works. With the success of Sierra Leone, we’re hoping to return to other countries and get a better reception.

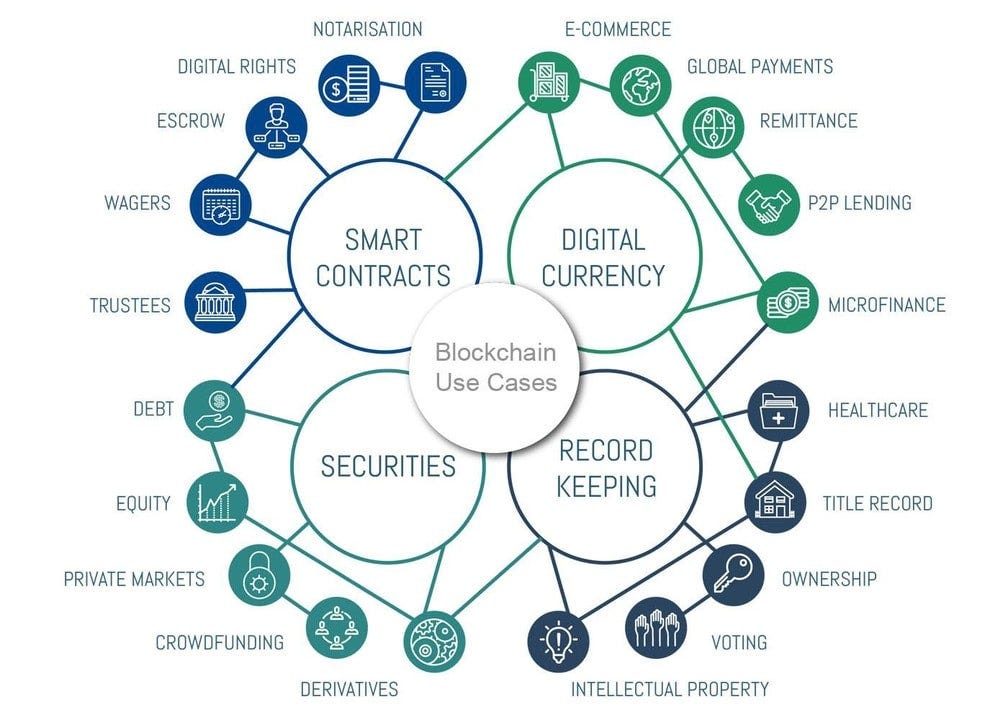

3. Users

With a focus on the user let’s look at a case from the Philippines. Celo (Peter’s former employer) collaborated with a community group, The Montalban Action Group (MAG) in a decentralised anti-poverty programme. The effort was 100% community-driven and the use of the tech was seamless and convenient. More importantly, it solved a real problem..

Must Read: From the Celo Community Blog: The Multiplier Effect of Communities: Spotlight on the Montalban Action Group

Excerpt: In her outreach to the first 20 members of the group, she tapped into the younger ones to become “onboarding assistants” who explained to their co-recipients how to download and use the impactMarket and Valora apps. They set up a group chat in Facebook as well, where they asked questions and resolved technical issues. In two days, the community was ready to receive the first UBI disbursement. In particular, Diane, a public school teacher, served as their go-to for technical support. Diane is more tech savvy than the rest of the group. “At first we had doubts but after we saw that it works, all of our members became confident that it was legit.” She also helps in facilitating the cash out for members through BloomX, a Philippine cryptocurrency exchange offering local off ramps.

Staying in the Philippines, CoFounder of Yield Guild, Berry Li recently wrote in CoinDesk:

Suggested Reading: A Play-to-Earn Account Beats a Bank Account

Excerpt: “This is why the play-to-earn phenomenon in non-fungible token (NFT) gaming is so powerful, because users don’t need to put money in – they can earn it through active participation in a video game. This is providing unprecedented access to wealth creation opportunities in crypto, especially in developing countries where we’ve seen a huge influx of people wanting to get in on the craze. But rising demand has dramatically increased the cost of the NFTs needed to play the game. Which places us right back where we started, with expensive admission fees putting play-to-earn games out of reach for those who could benefit from them the most.”

The video in the above text tells the story of a small community in the rural Philippines that turned to the NFT game, Axie Infinity, to earn an income in cryptocurrency during the COVID-19 pandemic. It is a must-watch for those like Peter, who appreciate good storytelling and real-life use cases from users.

“Blockchain and crypto are not just speculation for Africans, it is not something we play with, it is not futuristic, it saves lives and can boost economic growth for the continent. From voting to remittance, it is a lifeline for Africans.” Peter Oluwashina

Final Thoughts

In the conversation, Peter mentioned that there are roles in this space beyond being a developer. I also expanded on this by saying that everything seems to work best when each individual understands the role they (and the other ) play in the ecosystem. Adversarial relationships, in my view hinder progress. I saw this frequently in my previous career: bloody nightmare and absolutely exhausting! In a perfect world, the developer knows the marketer is essential. The marketer knows the importance of mentors and the like. No one is less important than the other. Rather, they are aligned with one goal in mind: solve a problem for the user. In a similar vein; regulators, builders and users must be educated in their own unique language and by employing different methods. Peter urged us all to look beyond the hype and money to see how we can utilise this technology to impact lives. It appears that beyond education, cohesion must be achieved before impact (and adoption) can be materialised.

Peter and I covered quite a bit in this conversation:

Peter’s Career Profile

What is Celo?

Learn About the Three Layers

Understanding Layer 1: Regulators & Their Responsibility

Understanding Layer 2: Business, Tech & Other Operators

The Blockchain Education Problem

The Need for More Communicators in the Blockchain Space

The Role Creators Should Play in the Blockchain Space

Understanding Layer 3: The Users

Common Marketing Blunders Made by Blockchain StartUps

The Importance of Storytelling

Marketers As a Part of the Design Phase

Being Obsessed with the Users/Consumers of the Product

Managing all Three Layers

Changing Lives with Blockchain Technology

🔶 Visit Rare Birds TV for video podcasts with early-stage founders from emerging markets. Our most recent episode features Trinidadian entrepreneurs Carla Williams-Johnson and Jamila Bannister. View Rare Birds TV here. 🔶

As always, thanks for reading and for exchanges, questions, critiques and collaborations message me via joann@rarebirdshq.com.

Bye for now and continue to stay Rare.

JoXx

Follow Rare Birds 👇

🔶 FaceBook 🔶 LinkedIn 🔶 Twitter 🔶 Instagram 🔶 YouTube🔶